Among the many “neo banks” that have appeared in recent years, Revolut is undoubtedly one of the best known, particularly for its innovative payment solutions. Since its inception in 2015, it has managed to carve out a place for itself in the world of online finance. Why has it become so popular? The answer is simple: Revolut combines security and simplicity with services designed for the modern world. Basically, it makes money management more fluid (and more fun too). Today, Revolut offers a multitude of options for saving and even investing, all at your fingertips via an intuitive application. But then, what is saving with Revolut really worth? And why can it be an interesting alternative to products like the Livret A? We tell you everything! Revolut: a digital bank that you can trust

Neo banks sometimes leave doubts: some have worked very well, others not, even from “traditional” banks that have tried to make a place for themselves (maybe it was because they came from the traditional, by the way?). It is therefore legitimate to ask the question:

Is the Revolut account reliable ? If Revolut has made a name for itself, it is also because it has made a point of honour of guaranteeing the security of its users' funds, who now number more than 45 million worldwide! The application is protected by multiple levels of security, ranging from two-factor authentication to virtual bank cards for online payments. In addition, Revolut accounts are now covered by a European banking licence. In other words, your deposits (up to €100,000) are guaranteed by a deposit protection fund. This is not a small news, it is a real guarantee of trust for customers! In addition, the app is extremely user-friendly, easy to use even for those who are not financial geeks. Savings at Revolut: an attractive alternative

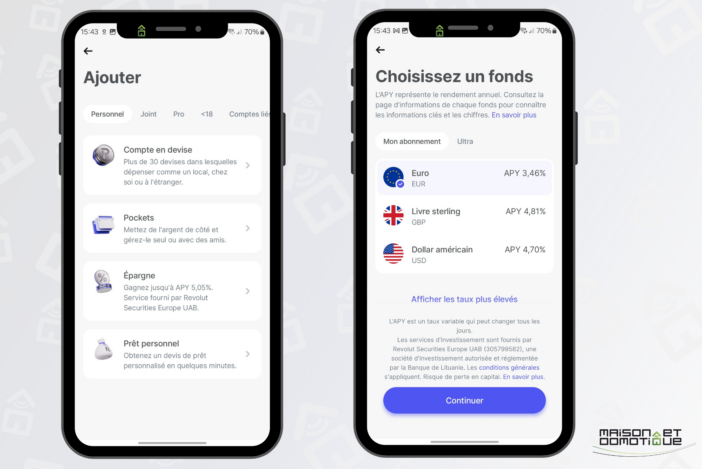

Revolut recently unveiled a savings offer that could well compete with classic French savings accounts, such as the Livret A. How does it work? Simple: Revolut offers savings boxes (called “Vaults” in the app). These boxes allow you to set aside money automatically from your everyday transactions. For example, every time you make a payment, Revolut can round up the amount to the nearest euro and deposit the difference into your savings box. It’s a painless way to save without thinking about it!

In addition to that, Revolut offers remunerated safes in partnership with major financial institutions. The interest rate varies depending on the period and the currency, but it is often aligned with what traditional savings accounts offer. The advantage? Flexibility! You can withdraw your money at any time without fees, unlike other solutions where penalties apply. This is ideal for people who like to have control over their savings while making them grow. And if you are used to traveling, you can have accounts in different currencies, within the same application. Conversions are established automatically if you need to draw on a foreign currency.

Options for those who want to go further: investing with Revolut

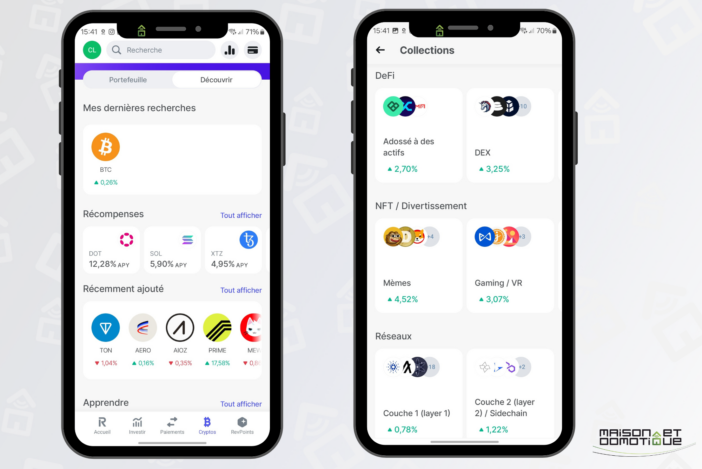

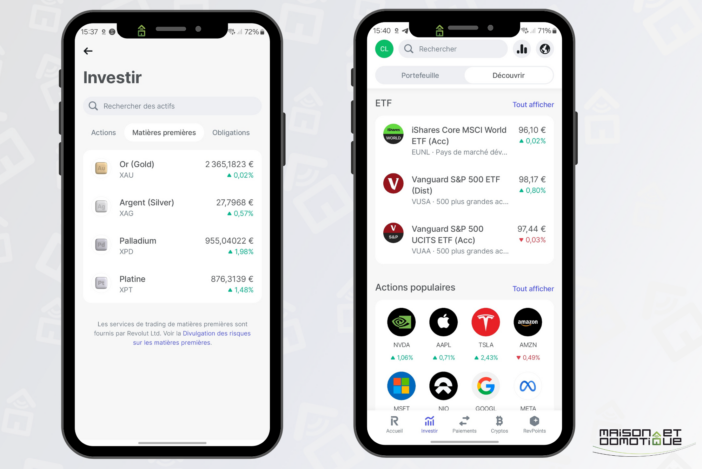

Saving is good. But with Revolut, you can also embark on more daring investments! Yes, Revolut allows you to invest directly from the application, whether in stocks, cryptocurrencies or even precious metals like gold or silver. And again, everything is done to make it accessible, even if you are new to investing. In itself, it is quite revolutionary, because with traditional banks it is very complicated to invest in this type of investment.

With stocks, you can even buy a fraction of a share, which means you don't need to have a fortune to start investing in companies like Tesla, Apple or Amazon. You can definitely put just €20 on a stock that is worth €500. This is an opportunity to diversify your investments and take advantage of market developments. And for those who want to explore the fascinating world of crypto, Revolut offers easy access to the main digital currencies (like Bitcoin, Ethereum, and many others). The application even offers themes for investing (VR, AI, etc.) if you don't know which crypto to focus on. Finally, you can also automatically convert your cryptocurrency earnings into euros if you wish! No more hassle with Exchanges and complicated transfers.

The cherry on the cake: precious metals

If you are more of the type to look for a safe haven, precious metals are just a click away on Revolut. You can buy gold or silver and resell them directly on the app, following the market price fluctuations. The fees are very transparent, and you can see in real time the performance of your investments. It is an ideal solution for those who want to protect their savings against inflation or economic turbulence.

Conclusion: saving and investing has never been easier

Please remain courteous: a hello and a thank you cost nothing! We're here to exchange ideas in a constructive way. Trolls will be deleted.