This is a topic that some have been waiting a long time to diversify their investments. Testing such investments takes time to find serious and viable projects over time. But here it is, today I'm going to talk to you about copy trading, introducing you to three traders I've been following for several months, and who have been successful in their field for several years. While the 800% profit headline may seem enticing, it's entirely true: that's indeed what one of the traders achieved in 2022! We'll come back to this in more detail later.

What is Copy Trading?

First of all, I think it's important to define two terms, necessary to understand this investment, for those who are unfamiliar with trading. We already mentioned them during the presentation of Acwin:

- Trading: Trading is an English word commonly used in France to refer to buying and selling transactions carried out on financial markets: stocks, financial options, futures contracts, currencies, indices, etc. The goal, of course, is to buy low and sell higher, thus making a capital gain, particularly through leverage. These transactions are called “trades,” and the person executing them is a “trader.” Anyone can be a trader: you and me. Although it's preferable to train beforehand, no training or diploma is required to be a trader. Anyone can buy a stock today and sell it tomorrow, but you can also buy a currency like the ruble or the dollar, or even gold, etc. Broker: The

- Broker is responsible for executing the trader's orders. They are an intermediary authorized to carry out these transactions on the financial markets. They are a financial entity accredited to carry out transactions on the financial markets. Your bank, for example, can act as a broker when you ask your advisor to buy a few shares in a company. Now, what is copy trading? It's actually a technique that allows you to copy a trader's actions in order to make the same profits as them. While technically anyone can be a trader, it's still a discipline that requires knowledge of the field. Without it, losses can quickly accumulate. Therefore, you need to be able to train yourself and dedicate a lot of time to it, as the trader's decisions are made in front of screens and charts, while closely following the news. In short, it's a full-time job. Copy trading therefore has many advantages:

No special skills are required to implement it.

- It works completely passively and requires no time: you can earn money on the financial markets even while you're working elsewhere or on vacation at the beach.

- Many brokers now offer copy trading features: simply open an account, deposit money, and subscribe to the trader you want to follow. The platform takes care of replicating the trader's operations on your account. It's completely automatic!

Of course, the trader doesn't do this for free: he or she is compensated through what is called “Profit Sharing” (or PS). From the outset, it is agreed that the trader will take a percentage of the profits, often between 20 and 30%. If you make a profit of €100 during the week thanks to the trader's trades, the trader will, for example, take €20 of your profits at the end of the week. This is also completely automatic; the platform manages this. Some may think this is “a lot,” but remember that in copy trading, you do absolutely nothing; it's the trader who works for you and earns you money. This compensation is therefore completely normal.

Personally, I prefer Profit Sharing to subscription-based systems like the ones we saw with Acwin. Indeed, with a subscription, whether there is a profit or a loss, you pay the subscription fee, no matter what. In the case of Profit Sharing, if the trader fails to make a profit, they don't receive any Profit Sharing. Suffice it to say that the trader has every interest in performing well if they want to earn a little living! It's true, however, that the subscription is less expensive if the profits are significant. Both systems have their advantages and disadvantages.

While many brokers currently offer copy trading, the one I particularly appreciate is Roboforex, for its quality and reliability. This broker, located in Belize, has been around for 13 years, with over a million clients, and is regulated by the FSC. You can find all the information about this broker on its dedicated page.

To join one of the traders featured here, you will, of course, first need to open an account on the Roboforex website. The procedure is standard: account creation, KYC (i.e., sending the necessary identity documents), then depositing funds, which can be done by wire transfer, credit card, or even cryptocurrency via the Advcash service.Creating a Roboforex Account

Note that a single Roboforex user account can accommodate multiple Metatrader 4 (MT4) accounts, and therefore multiple traders. For example, on my account, I have about ten copy trades running in parallel. Simply create a new MT4 account each time. Note: Roboforex does not accept cryptocurrency payments (only bank transfers or card payments). If you wish to use your cryptocurrencies, you can useAdvcash

Now let's discover these famous traders.

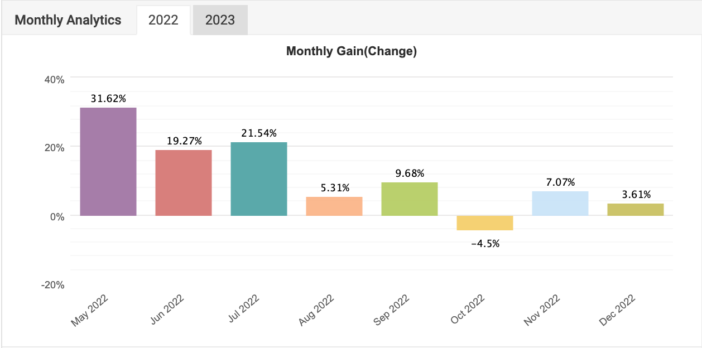

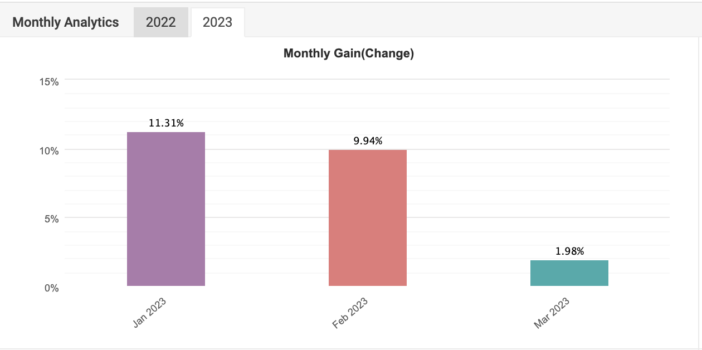

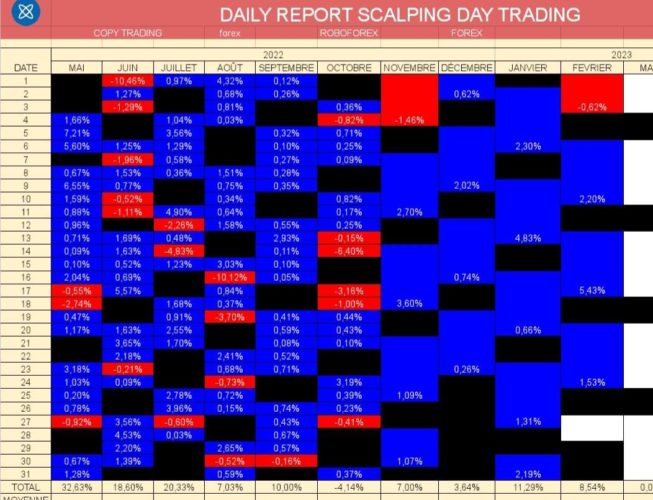

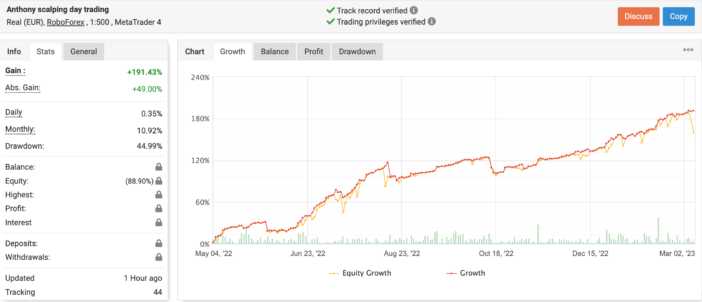

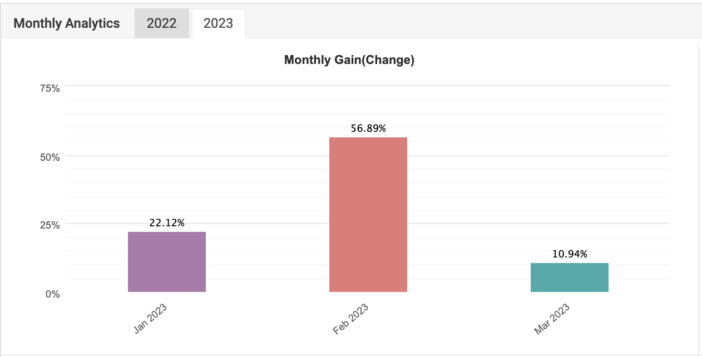

SDT: Scalping Day Trading, by Anthony Gheux Anthony is now a well-known trader in the field, having been trading since January 2020. Over the years, he has proven his reliability, transparency, and efficiency. Like any trader, he has of course suffered losses, and they still happen: it's the law of the market. But his SDT method is now well-honed, and Anthony demonstrates excellent trading skills.He achieves gains of +8 to 12% per month on average on Forex, which is the currency market, less dangerous than the gold market. The annual target excluding compound interest is 100% per year! In other words, double your capital in one year. A goal perfectly achieved in 2022: And 2023 has already started off strong:All results are available on his

MyFXBook account

.

Anthony offers a scalping-based strategy with predefined TP (Take Profit) and SL (Stop Loss) limits. In other words, profit targets are set for each trade, but a maximum risk is also defined if the market doesn't move in the right direction. This limits the risk of loss no matter what. In the industry, we refer to this as “Drawdown” (or DD): this is the risk of loss at any given time. Anthony rarely exceeds 10%, which is a highly controlled approach in this field.

He uses a 3-entry strategy, meaning he defines three entry points for a currency and enters three times for each. For example, instead of entering with a 0.30 lot size, he enters three times at 0.10. Rest assured, this is a detail for those who are interested, but there's no need to worry about it, the copy trading system handles everything for us :)

Anthony offers 100% transparency on profits and losses, through a performance tracking table updated weekly on the Telegram group. He also provides detailed analyses on his Telegram account to explain his trading plans, for those who are a little curious about what he does. A Discord channel is also available, where he also offers videos to teach trading.

In short, Anthony is passionate, loves to share his knowledge, and is very accessible if needed. Of course, trading remains a risky investment, with its risk of losses. There's no risk of being scammed, but there's the risk that the financial markets won't move in the trader's direction. Because it's nothing more or less than speculation. Losses may therefore occur from time to time, but as we can see from SDT's history, in the long run we largely win. All this without doing anything on our part!SDT is now one of my favorite investments, as Anthony has extensive trading knowledge and capital preservation is his priority.

Key points:

Download the SDT registration procedure

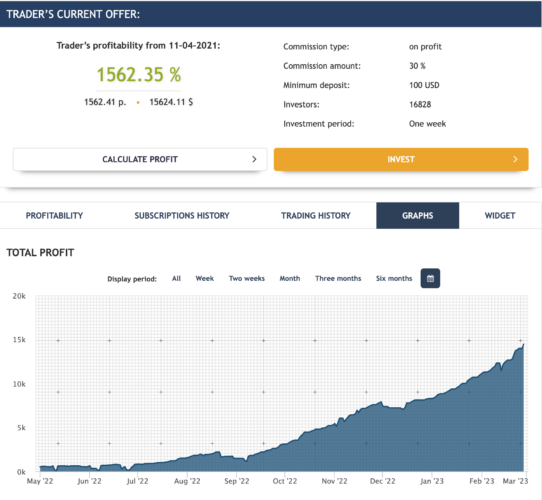

WSI: Wall Street Invest, by David Franke While Anthony focuses primarily on Forex, David Franke is 100% dedicated to a very specific index: the DAX, a German index. David Franke is German, also well-known in the trading world, particularly for his knowledge of the DAX and his impressive performance with his Wall Street Invest strategy: he has managed to achieve 800% profits in 2022! To date, more than 17,000 investors are copying him.Performance since the creation of his copy trading strategy Of course, significant profits also mean significant risks. But this trader has adjusted his technique in recent months and is taking fewer and fewer risks, because he's so widely copied that he now has over 60 million euros under management! There's inevitably a little more pressure than when you manage 10,000 euros. Rest assured, despite this, the profits are still there, as we can see for the start of 2023: Results closed on March 9, 2023…

He also has a

Telegram

(in German), and he communicates a lot on his

- u003ca href=u0022https://my.roboforex.com/register-copyfx/?trader=171747u0026amp;partner_token=752261c1u0022u003eCompte accessible à partir de 300$u003c/au003e

- Type de compte: Metatrader 4 Pro

- Profit Sharing de 25% prélevé chaque fin de semaine

Join WSI

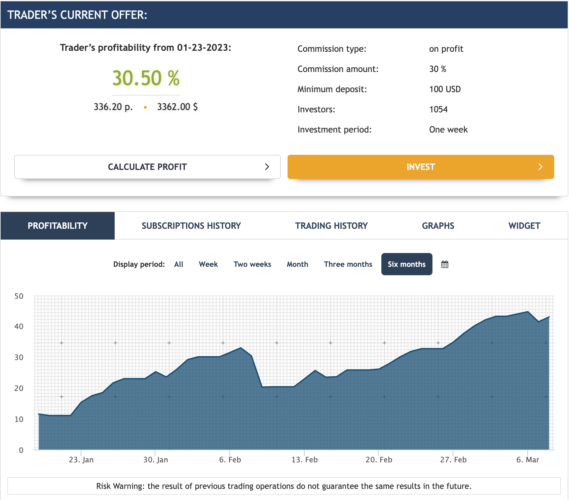

Meckie: The New Kid by Stefan McLoughlin Stefanwas trained by David Francke, who warmly recommended it to his community. It offers the same type of trading, on Forex, and particularly the EUR/USD pair, with very attractive profits and relatively limited risk, not exceeding 10%.

30% profit in just two months, with very controlled risk.

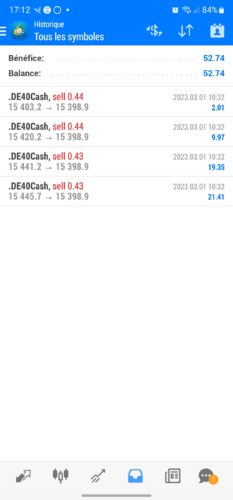

Join Meckie Security The broker (Roboforex) and the trader are clearly separated here. The trader himself won't be able to take off with your money. Even Profit Sharing is managed by the broker; under no circumstances can the trader use our account. At worst, they'll make bad trades that will result in losing trades. But this won't be profitable for either you or them, since they won't earn any Profit Sharing in this case. So, there's no point. Losing trades are of course possible, and the risk is there, but it won't be the result of a scam. The three traders presented here are performing well, closing the majority of days in the red. Being real people, not bots, it's possible that they don't trade on certain days, either because of economic announcements or because they don't deem it necessary. We've already seen some end their day at 10:00 a.m. because they had already reached their 1% profit target for the day… A clean and precise trading day on WSI, finished at 10:30 a.m. with 2.6% profit!The broker's capital, on the other hand, is safe. Roboforex has been around for 13 years, is regulated, and is one of the largest brokers in the field.

- u003ca href=u0022https://my.roboforex.com/register-copyfx/?trader=143640u0026amp;partner_token=a96f4c94u0022u003eCompte accessible à partir de de 100$ en optant pour un compte Pro Cent (compte en centimes), ou 1000$ en optant pour un compte MT4 Pro classiqueu003c/au003e

- Type de compte: Metatrader 4 Pro Cent (compte en centimes, pour capital inférieur à 1000$), ou 4 Pro (si capital supérieur à 1000$).

- Profit Sharing de 30% prélevé chaque fin de semaine

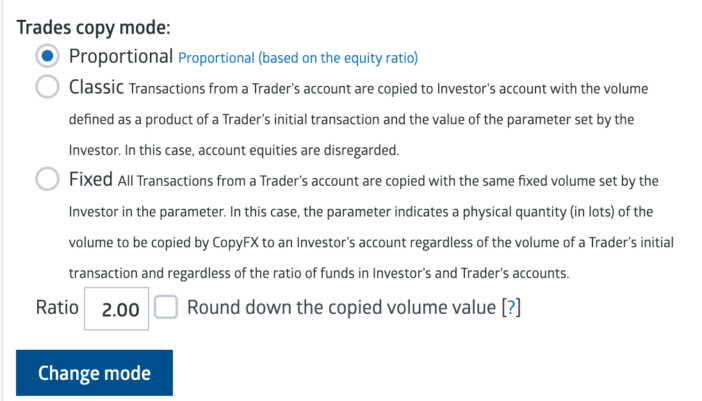

Be careful to always stay within the “proportional” range and not overdo the ratio!

I draw your attention to one point however: as we can see in Anthony's guide, it is possible to play on the ratios in Roboforex, to increase profits. A ratio of 2 for example will multiply the lot size by 2, and therefore increase profits… but also losses. Unfortunately, some, because of the lure of profit, use excessive ratios, sometimes exceeding ratio 5. With a ratio 5, you should know that if the trader reaches a Drawdown (risk of loss) of 20%, which remains very correct in the field, your account simply risks “burning”: 20% x 5 = 100% of your account! Traders' strategy is based on their positions and their “normal” level of risk. Even having reached 20% DD, the trader can agree to go up to 40% because he knows that the market will soon turn around and go his way, generating good profits. But if your account has a ratio that is too high, it will not be able to keep up and will be cut first by the broker. If we really want to be aggressive with such an investment, we can increase the ratio to 2, or even 3 maximum (while always remaining in proportional mode!). Conversely, if we want to be more calm, we can also lower it to 0.5 for example: we will make less profits, but the risk will also be halved compared to the trader's risk-taking. In short, the ratio is interesting, but should be handled with caution. When you're not sure, don't touch anything! For my part, I often have a main account in ratio 1, and a second account with smaller capital but a more aggressive ratio in 2 or 3, which helps limit the risk. Indeed, you can open several MT4 accounts and follow the same trader several times with different ratios ;-)

Taxation

Conclusion

- u003ca href=u0022https://my.roboforex.com/register-copyfx/?trader=220994u0026amp;partner_token=76bbbf4du0022u003eCompte accessible à partir de 100$u003c/au003e

- Type de compte: Metatrader 4 u003cspan style=u0022text-decoration: underline;u0022u003ePrimeu003c/spanu003e (Attention, type de compte différent des précédents !)

- Profit Sharing de 30% prélevé chaque fin de semaine

Today, there are many platforms offering copy trading. The problem isn't finding a copy trading platform, but rather finding a successful trader. Platforms like Roboforex offer a track record and various indicators that allow you to get a good idea of the trader you're choosing. You also have to be careful, because behind a copy trade can be just as much an experienced trader as a bot. And despite a good track record, you're never safe from losses. For example, after following a successful copy trader for six months, who had never made a loss before, I still lost an entire account: the market sometimes has incomprehensible reactions, and zero risk doesn't exist in this area, especially when the trader doesn't set a stop loss. :/

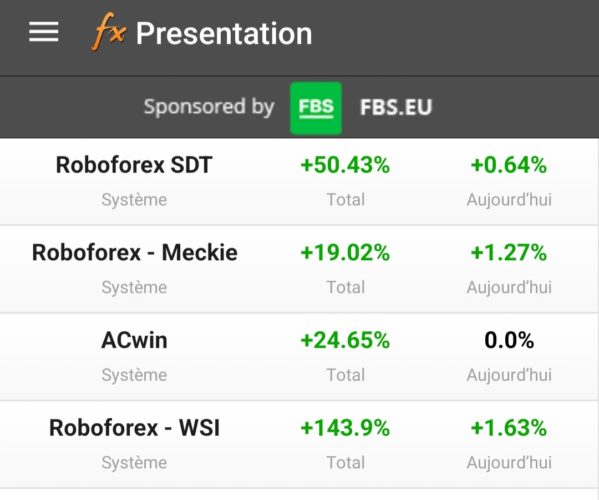

That's why it's important to always diversify. Don't put everything into a single trader, and don't limit yourself to a single market. Three gold traders, for example, may have different results, but if the market reacts sharply, all three are still likely to experience difficulties. Here, we have one trader on Forex, one on the Dax, and the other on the EURUSD. If one trades poorly, the others compensate. Here's an example of the four trades I've already presented since I started following them:

Also remember to regularly secure your profits: compound interest is magical, but if an account goes into overdrive, you risk losing both your initial capital and all the profits generated over the months. Personally, I withdraw at least half of the profits every weekend, after the Profit Sharing is deducted. This way, the account grows little by little, bringing in more and more, but I have a portion of the profits set aside in case a problem arises with the account.

I hope this was clear enough! If not, the comments are for questions! This is a somewhat complex area at first glance, but fascinating, and ultimately quite simple once the basics are understood.

Please remain courteous: a hello and a thank you cost nothing! We're here to exchange ideas in a constructive way. Trolls will be deleted.