Yes, I know, the title and image are very similar to the article I wrote about Cryptocom a little over a year ago. And for good reason: it's the most similar credit card service I've found as an alternative: Plutus. A service that allows you to get a refund for your Netflix and Spotify subscriptions (among others), while receiving 3% cashback on all your spending. Having used it for several months now, I invite you to learn more about it. Crypto.com allowed you to get a refund for your Netflix and Spotify subscriptions, while receiving 3% cashback on all your spending. However, using it required you to lock up a certain amount of money, which earned 10% interest annually. It's a brilliant system, and I used it for almost two years. Unfortunately, the benefits of this bank card have declined considerably in recent months: firstly, with the reduction in the 1% cashback and its $50 cap, the reduction in the remuneration of blocked funds, and then, since the beginning of January, the end of Spotify and Netflix reimbursements. But competing offers quickly emerged. So, since May 2021, I've been using a new card: Plutus . There's no need to block any amount of money, yet Plutus offers 3% cashback on all our purchases, and allows us to be reimbursed for two services per month from a wide range: Spotify, Netflix, Amazon, Disney+, but also other brands like Lidl, AirBnB, etc. It has become my primary payment card, coupled with Curve(which also benefits from a partnership, with Plutus even able to reimburse us for the cost of the Curve card each month!).

The advantages of the Plutus card Like Crypto.com,Plutus is a company primarily specialized in cryptocurrencies, allowing you to buy and sell cryptocurrencies. It offers numerous services, including the possibility of obtaining a Visa debit card, accepted in all stores. A completely free card, like those offered by most neobanks today, and associated with a mobile app to track your spending. So far, nothing surprising. While this card was originally created to be able to spend your cryptocurrencies (ETH and PLU), it can also be used as a “rechargeable” card: you transfer euros to this card via a SEPA transfer. When you go shopping, online or in-store, you can then pay like with any other bank card. But paying with the Plutus card offers many advantages.

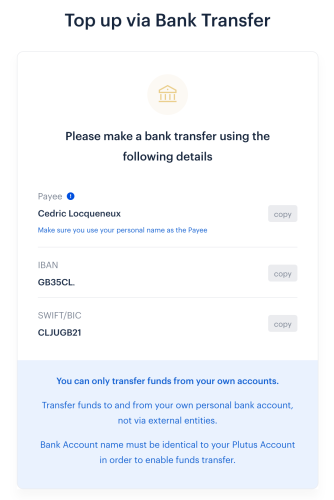

A classic SEPA transfer and your Plutus account is credited with the desired amount.

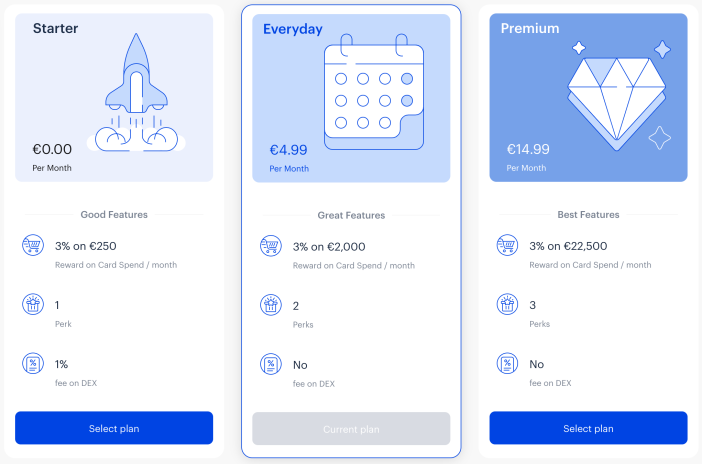

These benefits will vary slightly depending on the type of plan chosen. Unlike Cryptocom, there's no need to block a sum of money to enjoy these benefits. And that's a big plus! Basically, as soon as your account is opened and the card ordered, without doing anything else, you can enjoy 3% cashback on all your purchases made with this card. You also benefit from a “perk,” a bonus on a service of your choice: this could be a refund for your Spotify or Netflix subscription, €10 cashback on your Lidl shopping, etc. All this for free! There's only one limitation: cashback is only credited on the first €250 spent each month. The company then offers two subscription plans, which can be canceled at any time: “Everyday” Plan: still 3% cashback, this time with two “perks,” and cashback up to €2,000 spent per month. The subscription costs €4.99 per month.

Premium Plan: Still 3% cashback, but this time with 3 perks, and cashback up to €22,500 per month. This plan costs €14.99.

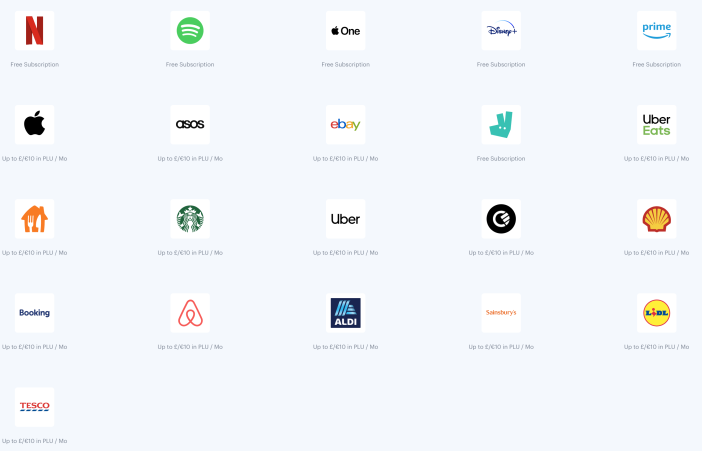

listed here

). The difference lies in the bonuses (number of services that can be reimbursed), but especially in the amount of spending counted toward cashback.

- All perks currently available.

- Personally, I've been on the Everyday plan since the beginning, at €4.99/month. This is the offer that seems most relevant to me for everyday use. With a spending limit of €2,000 for all my purchases for the month, it's more than adequate for me, whereas the free version was a bit too restrictive, with only €250 counted toward cashback. By making absolutely all my purchases each month with the Plutus card, the cost of the subscription is more than covered: if we take even the monthly grocery shopping, for example, at €500, that already gives us €15 in cashback. That's three times the price of the subscription. And that's a minimum! The two “perks” allow me to reimburse my Spotify and Netflix subscriptions (not in full because the reimbursement is capped at the basic subscription plan, and I have the Family and 4K versions, which are a little more expensive. But the majority of the subscription is reimbursed). Note that the “perks” can be modified from one month to the next if necessary, depending on your planned expenses, if you know you'll have an AirBnB rental the following month, etc. It's important to know that cashback on spending, as well as perks like Spotify and Netflix subscription refunds, are not paid directly in euros, but in

My Use of the Plutus Credit Card in Practice

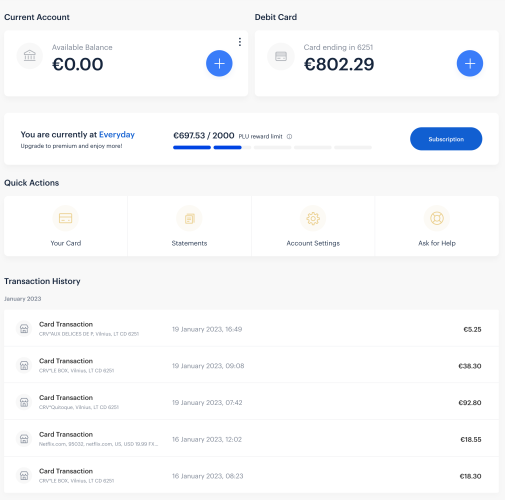

This Plutus credit card has become my primary payment method. Of course, my Netflix and Spotify subscriptions have been migrated to it, allowing me to be reimbursed for these subscriptions. A significant gain, since it represents €10/month for Spotify, and €11/month for Netflix, or €252 per year. Without doing anything! Then, all my daily expenses are paid with it. In fact, at the beginning of the month, from my traditional bank, I transfer the amount that roughly corresponds to the amount of my credit card expenses each month. All you have to do is make a standard SEPA transfer to your Plutus account number. In practice, the transferred money arrives in the “Available Balance,” and two clicks are enough to then transfer the money to the “Debit Card” to be able to pay for your expenses (avoid weekends, as transfers are made during working hours).I no longer use my bank card, only my Plutus card. For example, if you usually spend €1,000 per month by credit card, that represents €30 in cashback, or about 3 PLUs. Groceries, restaurants, internet purchases, parking, even my water bills… everything that can be paid for by credit card goes through it. Except for one thing: gasoline. Because like many solutions of this type, the system automatically debits the maximum amount authorized at the gas station (a provision) and pays us the difference a few days later. Personally, I don't like this principle, because if I fill up for €60 and the maximum authorized amount is €150, I have €90 disappearing from my account for a few days, while I wait for it to be recredited. Also be careful with installment payments: while purchases on Amazon earn cashback, the free 4-installment payment offered by the American giant doesn't earn cashback, because the payment is made by Cofidis, a financial institution, and not Amazon :/ Good to know!

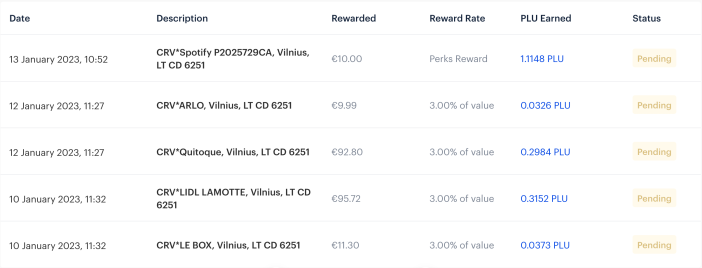

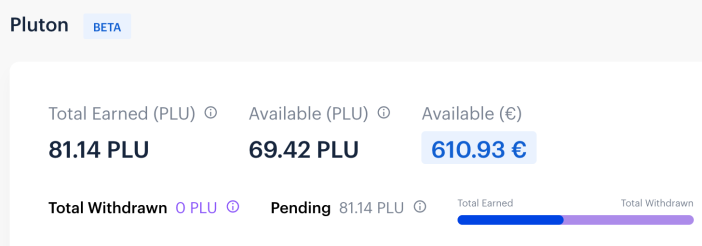

In the end, with an average monthly spend of €1,000 by credit card, plus reimbursed Spotify and Netflix subscriptions, that's more than €600 recovered per year, or about 65 PLU (Local Local Units) at the current rate. And that's just a projection, as I've been a user since May 2022, less than a year, and I've already acquired more than 81 PLU (more than €750 at the current rate):

Even after deducting a €60 subscription to the Everyday plan, the deal is still very profitable!

You can then go even further if you decide to “stack” PLUs. Much like Cryptocom, you can “block” a certain amount in PLUs to enjoy even more benefits. Each tier provides an additional cashback percentage, as well as an additional bonus. For 250 blocked PLUs, you can reach a 4% bonus and 4 perks. And this skyrockets to 8% cashback and 8 perks for 2,000 blocked PLUs (which still amounts to over €19,000 blocked, which isn't for everyone :p). But I repeat: there are absolutely no obligations, and the free plan with no funds blocked works perfectly!

For my part, I've stuck with the basic Everyday plan, and I'm slowly accumulating PLUs through my purchases. PLUs that I can use later to increase my cashback rate. But for now, this plan works well for me and doesn't require me to tie up any money.

In short, having tested various cards offering cashback, like the Binance one for example, it's clearly the card that pays the most to date. And to use it, you don't even need to be interested in cryptocurrencies, since you load it in euros and spend in euros. So there are no constraints regarding crypto taxes either, just the declaration of this account abroad, as you already do for an account with N26, Revolut, etc. It's a prepaid card, with lots of benefits, that's all.

To take advantage of this great card, it's simple: just sign up. You can sign up on your own, or through my referral link, which will give you a $10 bonus (and me too ;-) It's always a good idea! Please note: this bonus only works if you activate your account within 45 days.

I'm opening a Plutus account and taking advantage of the $10 bonus.

In practice, you create your account, request to subscribe to the plan you want, and make a transfer to activate the account and trigger the card delivery. A few days later, you'll receive your Plutus credit card to use for your purchases. All that's left to do is change the payment method for your Spotify and Netflix (or other) services to benefit from the cashback.

Conclusion

In recent years, I've used many cards offering cashback. The Cryptocom one was very generous, but the new terms are now much less favorable. So, I quickly started looking for an alternative, and I must say that the Plutus one is by far the most advantageous and the least restrictive to use. Many services reimbursed, including Spotify and Netflix, 3% cashback, and all this with no commitment or money tied up!

I can only find two flaws with this card. First, it's not compatible with Google Pay or Apple Pay. But since I actually use it behind my Curve card, which is Apple Pay compatible, it's not a problem! Plus, Curve is included among the “perks,” so it's possible to get the cost of the Curve card reimbursed directly in PLU, since the two companies have partnered. Using the Curve card also allows you to have a second card for your spouse, for example: one can pay with the Plutus card, the other with the Curve card. This way, all household expenses benefit from Plutus cashback :p Finally, the icing on the cake: the cashback from both cards can be combined! For example, on my Curve card, I've activated cashback for the Lidl store: Curve gives me 1% cashback, and Plutus 3%.

Second small drawback: the transfer time between the available balance, after making the transfer, and the bank card itself to be able to use the balance for payments. This can sometimes take up to 24 hours. This makes it impossible to top up your card at the last minute before checking out, as I was able to do with the Cryptocom card. You just have to plan to load your card a little in advance; it's a habit to get into. Apart from that, this card works perfectly! Maybe the bonuses and cashback will decrease one day like Cryptocom did, it's hard to know. In the meantime, it works perfectly, and it's free with no commitment. As Jean-Pierre Nadir so aptly put it: you have to take the money when it's on the table :p So I'm taking advantage of the benefits of this card while it offers them, as I did with Cryptocom. The day it's no longer attractive, I'll move on. In the meantime, it's making me money :)There you go, I hope I've answered all your questions! If you have any other questions, don't hesitate to ask; the comments are here ;-)

Please remain courteous: a hello and a thank you cost nothing! We're here to exchange ideas in a constructive way. Trolls will be deleted.